Build durable wealth

through real estate

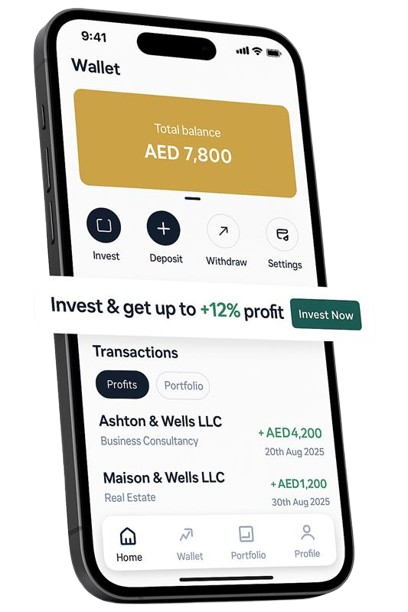

Access curated UAE residential and commercial opportunities — from co-ownership and pre-leased assets to structured property funds. Invest from as little as AED 25,000 and join an international community seeking steady income and long-term capital appreciation with Gains & Wells.

Request a Callback

Shaping Tomorrow’s Investments

Discover exclusive opportunities in equity, real estate, and high-growth ventures. Our platform connects global investors with ambitious startups and projects in the UAE — unlocking growth, diversification, and long-term value.

Investments involve risk, including potential loss of capital. Learn moreStart your journey with as little as AED 25,000

Access curated opportunities across sectors — from real estate to equity and high-growth ventures. Invest small, think big, and grow with the UAE’s most promising markets.

Diversify your portfolio with confidence

Choose from a range of investment models — equity, properties, and movable assets — designed to maximize returns and reduce risk while supporting thriving businesses.

Generate regular income & rewards

Benefit from rental yields, profit-sharing, and long-term appreciation. Your investments don’t just sit — they work for you every single month.

Build long-term wealth with smart investments

Watch your portfolio expand as businesses scale, properties appreciate, and new opportunities open doors to lasting financial growth.

Secure predictable returns with pre-leased assets

Invest in properties that come with pre-signed lease agreements from quality tenants. Pre-leased opportunities deliver steady, contract-backed income from day one and reduce vacancy risk — ideal for investors seeking reliable cash flow and lower operational burden.

Own prime assets together — lower entry, shared upside

Co-ownership lets investors hold proportional shares of high-value properties or projects. By pooling capital, you access premium assets with reduced upfront cost, formal ownership rights, and structured exit options — a balanced approach to growth and diversification.

How your investment creates returns

Join a growing community of investors building income and capital appreciation through structured real-estate opportunities. Typical outcomes depend on model and holding period — read examples below to understand how returns are generated.

Pre-Leasing — predictable, contract-backed income

Pre-leased assets come to the market with leases already signed by quality tenants. That means cash flow begins immediately, vacancy risk is reduced, and income is contract-backed from day one.

Typical holding periods: 3–7 years. Returns shown are illustrative based on past pre-leased deals and depend on specific lease terms, asset class and location. Past performance is not a guarantee of future results.

Co-ownership — access premium assets with a lower entry

Co-ownership enables investors to buy proportional shares in high-value properties. You gain ownership rights, receive your share of rental income, and participate in capital appreciation when the asset is sold or refinanced.

Typical holding periods: 4–8 years. Estimated returns reflect combined rental yield plus projected capital appreciation; actual results vary by asset, market conditions and exit timing.

How we protect your capital & interests

We operate strictly within UAE regulatory frameworks and align with international best practices to ensure maximum investor protection.

Every project undergoes a rigorous compliance process that covers KYC/AML screening, licensing and ownership verification,

and validation against all applicable local laws and regulatory requirements.

Our approach is designed to create a transparent, safe, and trustworthy environment where investors know their capital is protected

and managed responsibly. By working with licensed partners, legal advisors, and independent auditors, we maintain the highest

standards of accountability at every stage of the investment process.

Every investor and issuer is verified through strict Know Your Customer (KYC) and Anti-Money Laundering (AML) checks before any funds are processed. These safeguards prevent fraud, protect our community, and ensure compliance with UAE Central Bank and international financial security standards.

All investment opportunities are supported by clear governance policies and structured reporting schedules. Investors receive regular updates on project performance, while independent third-party audits ensure accuracy and accountability. Transparency is not optional — it is built into the very foundation of our platform.

Protecting investor ownership is at the heart of our model. Every investment is supported by

legally recognized documentation such as title deeds, registered share certificates,

nominee or trustee agreements, and escrow arrangements.

These safeguards ensure that your stake is recorded, verifiable, and legally enforceable.

By working with licensed custodians and trustees, we eliminate ambiguity and create a reliable

legal framework that secures your capital and future returns.

All investor funds are handled through regulated escrow and custody accounts, ensuring that capital is only released once deal conditions are fully met. This minimizes counterparty risk and provides a transparent, trackable flow of funds from investment to execution.

Each offering clearly defines investor rights, including voting privileges, profit-sharing, exit options,

and dispute resolution procedures. Agreements are governed by UAE law and may include arbitration or

court enforcement mechanisms to ensure legal protection.

Our commitment is simple: you retain enforceable ownership rights, supported by

transparent legal frameworks that give confidence to both local and international investors.