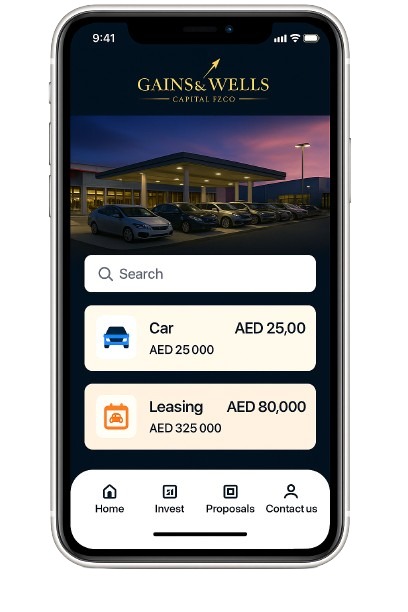

Earn predictable income through

car rentals & leasing

Invest in high-demand vehicle fleets and leasing programs across the UAE — structured to generate steady rental income, resilient demand and clear exit options. Startups and fleet operators: list your leasing business to raise growth capital and access our investor network.

Request a Callback

Invest in Car Rentals & Leasing – Earn Up to 25% Annual Returns

Tap into one of the fastest-growing sectors in the UAE. From short-term rentals to long-term leasing models, enjoy steady cash flow, high demand, and strong ROI potential.

Car Rental

Generate recurring income from daily, weekly, and monthly rentals. A thriving tourism and business market in the UAE ensures strong and consistent demand.

Car Leasing

Stable long-term contracts with individuals and corporates deliver predictable cash flow and reduced risks, while rising demand for mobility ensures steady growth.

Lease to Own

A growing model in the UAE where customers lease vehicles with the option to buy. This hybrid approach combines rental income with asset value appreciation.

High ROI from Car Rental & Leasing Investments

Whether you invest in short-term rentals or long-term lease-to-own models, the UAE mobility market offers consistent demand, strong profitability, and sustainable growth opportunities.

Car Rental Investment

Steady income from daily, weekly, and monthly rentals. Ideal for investors seeking reliable cash flow with moderate entry costs.

Leasing & Lease-to-Own

Long-term contracts with individuals and corporates. Higher security and predictable returns, with opportunities to capture asset appreciation through lease-to-own models.

Key Benefits

- Stable monthly payouts backed by long-term contracts

- High demand from residents, corporates, and tourists

- Ownership flexibility with lease-to-own options

- Strong regulatory support in UAE automotive leasing

Unlock new opportunities with UAE’s car rental & leasing market

The UAE’s thriving tourism, expatriate population, and corporate sector have made car rentals and leasing one of the fastest-growing investment avenues. With demand for flexible mobility solutions on the rise, investors can benefit from strong annual yields and consistent cash flow.

Our platform connects you with high-potential rental and lease-to-own opportunities while ensuring due diligence, market analysis, and professional fleet management for hassle-free growth.

Why Choose This Sector?

- High demand from tourists, residents, and corporates

- Flexible models: rentals, leasing, and lease-to-own

- Professional fleet and operations management

- Attractive ROI up to 25% annually

- Diversification beyond traditional real estate

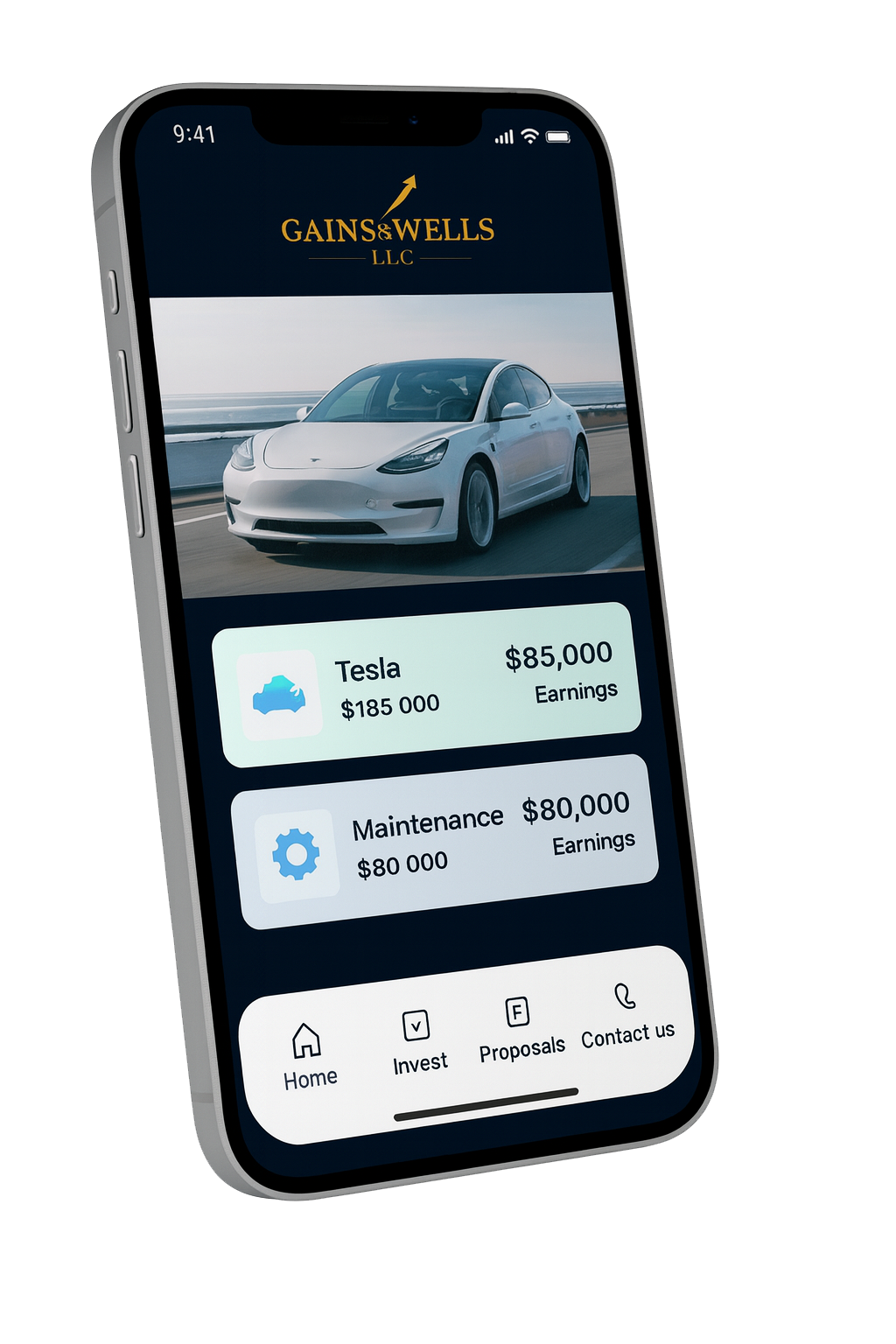

Invest Smarter with Automated Strategies

Our platform simplifies investing by using intelligent automation tools that save time, minimize risks, and maximize returns.

Auto Portfolio Allocation

Diversify across equity, properties, and assets with intelligent auto-distribution of your funds.

Real-Time Monitoring

Track performance with automated updates, insights, and ROI calculations delivered instantly.

Risk-Managed Investing

Set your preferences and let automation optimize investments while protecting your capital.

Exit Strategies for Investors

We make it simple for you to liquidate or adjust your portfolio. Investors can exit their positions through structured opportunities designed to maximize value and flexibility.

Every 6 months

Bi-Annual Exit Window

Investors can sell their shares twice a year through our community marketplace, providing liquidity without waiting for a full project exit.

Learn moreFlexible Exits

Early Redemption Options

In select cases, investors may redeem their positions early or transfer them, subject to project terms and regulatory approval.

Our Step-by-Step Investment Process

Every investment goes through a carefully designed process to safeguard capital, optimize performance, and ensure investors gain maximum returns with full transparency.

Step 1

Rigorous Opportunity Screening

We conduct in-depth market research and due diligence to identify profitable opportunities across real estate, car leasing, and other growth sectors in the UAE. Only projects with strong fundamentals move forward.

Step 2

Structuring & Compliance

Each deal is structured to protect investor interests through transparent agreements, escrow mechanisms, and compliance with UAE laws. Our goal is to minimize risks while maximizing ROI.

Step 3

Ongoing Asset Management

Once invested, we actively manage operations, track performance, and provide investors with clear updates. From rental income to exit strategies, we ensure your capital works efficiently for you.

Driving Growth Through Mobility

The UAE’s car rental and leasing market is expanding rapidly, driven by tourism, corporate demand, and the rise of flexible ownership models. With Gains & Wells, investors can tap into high-yield mobility ventures, while startups gain the funding and visibility needed to scale faster.

Whether you’re looking to diversify your portfolio with steady leasing returns or seeking capital to grow your rental business, this is the platform where opportunity meets growth.